Corporate Income Tax Due Date 2024

Corporate Income Tax Due Date 2024. The s corp tax deadline for 2023 (and beyond) is usually march 15 for most taxpayers. 31, 2024) are due today.

Instead, the company’s owners report that income (or loss) on their own personal income tax returns. 31, 2024) are due today.

Unless Otherwise Noted, The Dates Are When The Forms Are.

January 2024 to june 2024.

Here Are The Dates And Irs Forms You Need To Know.

There are four quarterly estimated tax payments that must be made in a fiscal year.

Tuesday, October 15, 2024, Is The Final Extended Deadline (For The Fiscal Year Ending December 31, 2023) To File Individual And Corporate Tax Returns For The Tax Year 2023.

Images References :

Source: www.patriotsoftware.com

Source: www.patriotsoftware.com

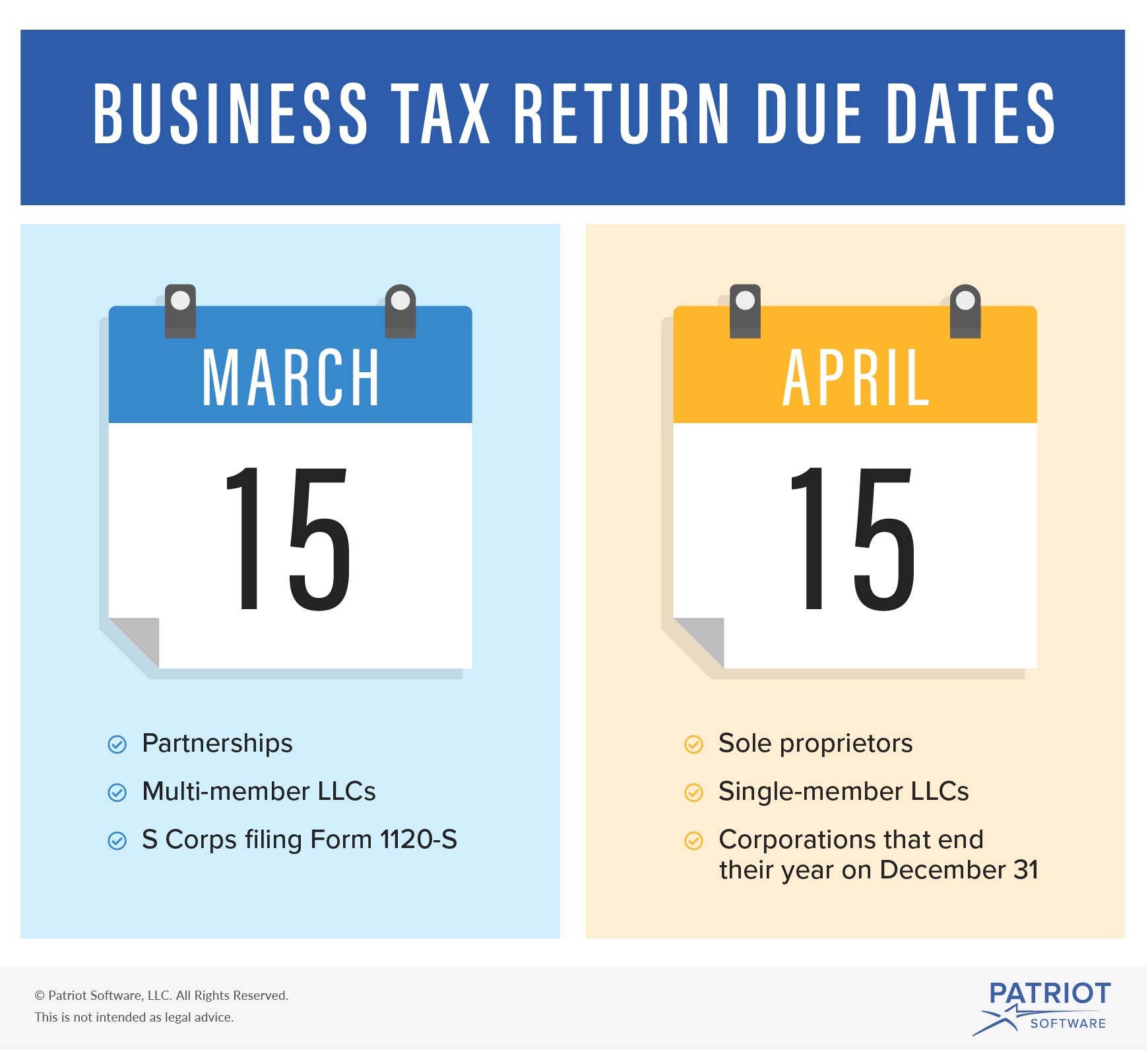

Business Tax Return Due Date by Company Structure, Federal income tax returns are due on april 15, but there are several other important dates to remember throughout the. The estimated quarterly tax payment for the period spanning april 1 to may 31, 2024, is due today.

Source: checkersaga.com

Source: checkersaga.com

2024 Tax Calendar Mark Your Dates! Filing Season and Key Deadlines, Every 2024 tax deadline you need to know. The estimated quarterly tax payment for the period spanning april 1 to may 31, 2024, is due today.

Source: bu.com.co

Source: bu.com.co

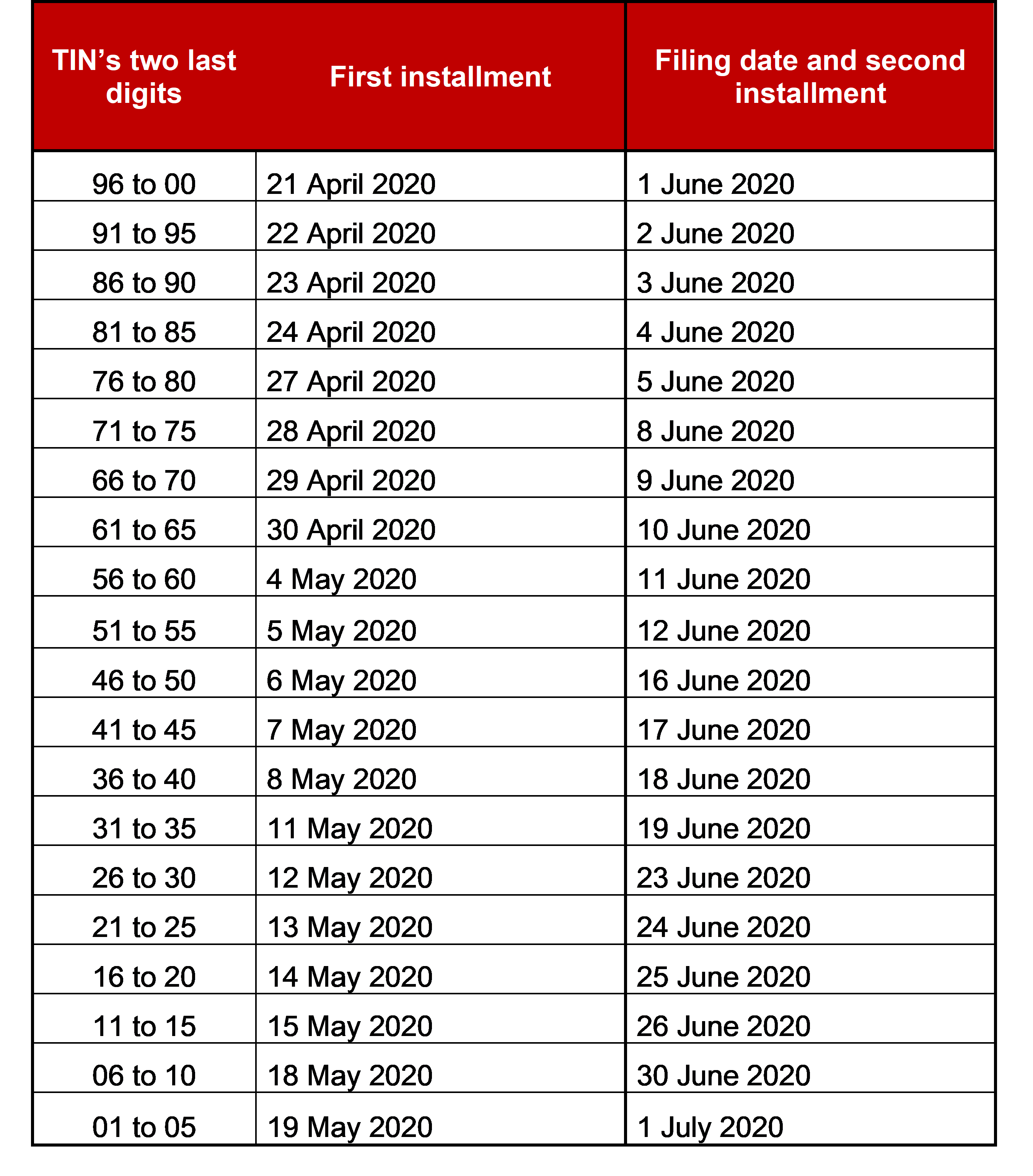

Corporate Tax filing and paying due dates postponed Brigard, There are four quarterly estimated tax payments that must be made in a fiscal year. Unless otherwise noted, the dates are when the forms are.

Source: dulcineawsabra.pages.dev

Source: dulcineawsabra.pages.dev

Due Date For Business Taxes 2024 Geneva Charita, The 2024 deadline to file individual. Here are the dates and irs forms you need to know.

Source: celkaqminetta.pages.dev

Source: celkaqminetta.pages.dev

Irs All Tax Deadline Dates For 2024 Amitie Andriette, Key tax deadlines are coming up in 2024 for llc and corporation businesses. The 2024 deadline to file individual.

Source: qatax.blogspot.com

Source: qatax.blogspot.com

What Is The Due Date For C Corporate Tax Returns QATAX, Federal income tax returns are due on april 15, but there are several other important dates to remember throughout the. See determining your corporation's tax year for more information.

Source: facelesscompliance.com

Source: facelesscompliance.com

Revise Tax Due Date Chart for FY 202122 after 20th May, 303 rows north macedonia (last reviewed 28 february 2024) the due date for the cit return is the end of february or, if filled electronically, 15 march following the calendar. Instead, the company’s owners report that income (or loss) on their own personal income tax returns.

Source: facelesscompliance.com

Source: facelesscompliance.com

Know Revised Due dates for Tax Returns, Audit and GST Faceless, The s corp tax deadline for 2023 (and beyond) is usually march 15 for most taxpayers. Instead, the company’s owners report that income (or loss) on their own personal income tax returns.

Source: savingtoinvest.com

Source: savingtoinvest.com

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, Instead, the company’s owners report that income (or loss) on their own personal income tax returns. If the due date falls on a saturday, sunday, or legal holiday, the due date is.

Source: www.consultease.com

Source: www.consultease.com

Revised Dates of Various Compliances or Payments under Tax Act, 31 jan 2024 property tax 2024 property tax bill. January 2024 to june 2024.

The Estimated Quarterly Tax Payment For The Period Spanning April 1 To May 31, 2024, Is Due Today.

For example, if a corporation operates on a calendar year, the due date for its form 1120 would be april 15, 2024, for the 2023 tax year.

For Corporations With A Fiscal Year That.

303 rows north macedonia (last reviewed 28 february 2024) the due date for the cit return is the end of february or, if filled electronically, 15 march following the calendar.